MacSync Stealer Returns: SEO Poisoning and Fake GitHub Repositories Target macOS Users

An active infostealer campaign is targeting macOS and Windows users across various sectors. The threat actors are using SEO poisoning to direct victims to fake GitHub repositories impersonating legitimate tools like PagerDuty. The campaign involves over 20 malicious repositories active since September 2025. The attack flow begins with a Google search, leading to a fraudulent GitHub repository, then to a GitHub Pages site with a deceptive command. This command deploys the MacSync stealer in three stages: a loader, a dropper, and the final payload. MacSync aggressively harvests credentials from browsers, cloud services, and cryptocurrency wallets. The campaign's scale includes 39 identified malicious repositories, with 24 still active as of January 2026. Evasion tactics include using 'readme-only' repositories and distributed identities.

Pulse ID: 69772ba9dd9a67872ce009f7

Pulse Link: https://otx.alienvault.com/pulse/69772ba9dd9a67872ce009f7

Pulse Author: AlienVault

Created: 2026-01-26 08:54:01

Be advised, this data is unverified and should be considered preliminary. Always do further verification.

#Browser #Cloud #CyberSecurity #GitHub #Google #ICS #InfoSec #InfoStealer #Mac #MacOS #OTX #OpenThreatExchange #SEOPoisoning #Windows #bot #cryptocurrency #AlienVault

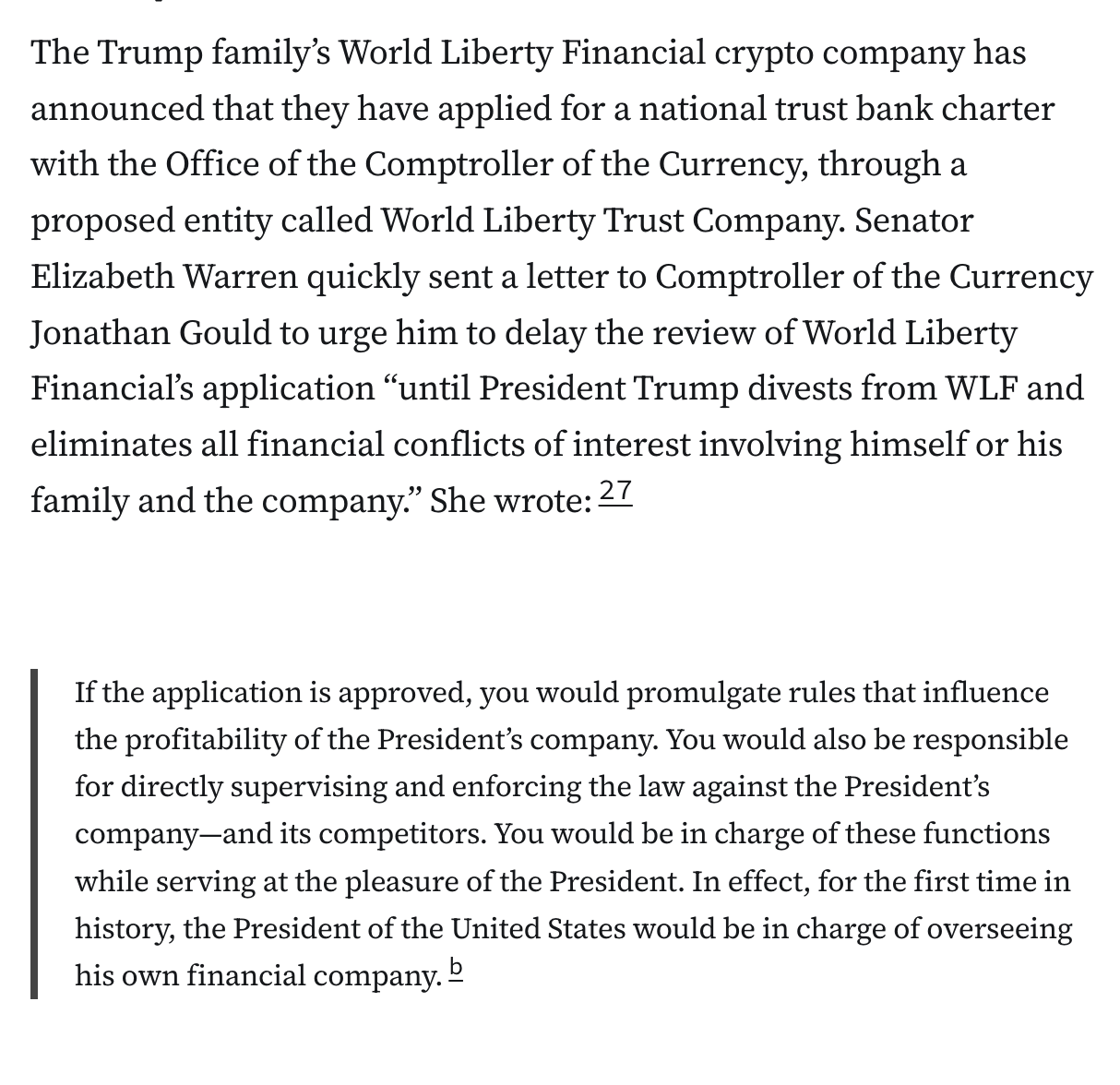

![The CFTC has a new Chairman now that the Senate has confirmed Michael Selig. Selig’s background is primarily in private practice representing crypto clients like Paradigm and eToro.20 In 2025, he briefly served as chief counsel for the SEC’s crypto task force, but besides that, Selig has extremely minimal regulatory experience — particularly in the many non-crypto markets the CFTC is expected to regulate.

Selig is also the only commissioner at the normally five-person CFTC, as Trump has seized control of regulators by appointing his own loyalists without appointing replacements for departing commissioners. Acting Chair Caroline Pham had previously announced she planned to leave when a chairman was appointed, and she has followed through on that promise. She immediately rocketed through the revolving door right into the lap of the crypto firm MoonPay, where she is now chief legal and administrative officer.21 You might recognize MoonPay as a frequent Trump crypto partner, helping process payments for both the $TRUMP memecoin and for Melania Trump’s 2021 NFT projects. You also might remember that they snagged that lucrative Trump memecoin partnership only weeks after attempting to make a $250,000 contribution to Trump’s inaugural committee, but got scammed instead [I88].](https://media.hachyderm.io/media_attachments/files/115/923/015/693/723/737/original/f50e9ddae12bca93.png)

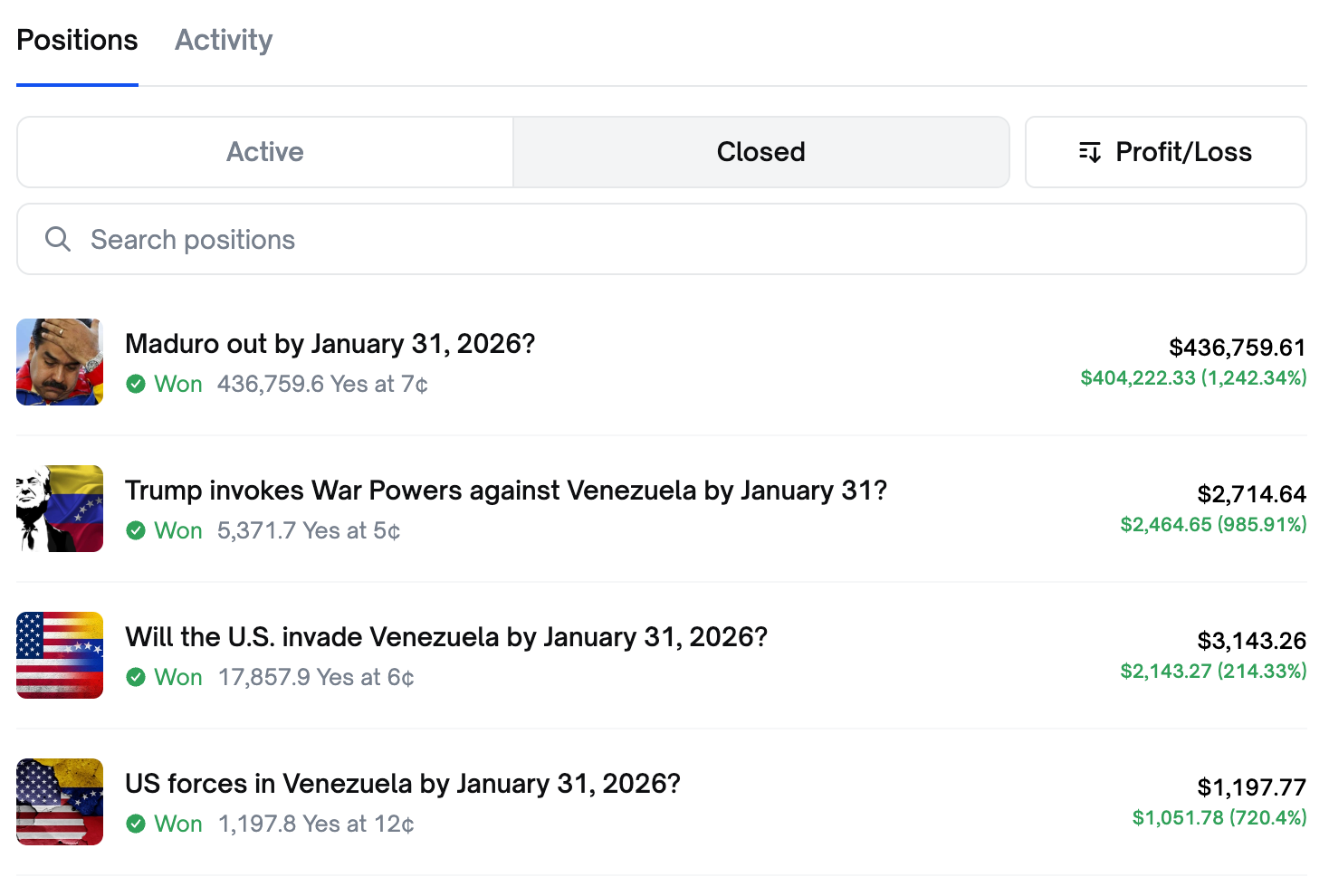

![Days later, Representative Ritchie Torres (D-NY) introduced a bill seeking to prohibit elected officials and other politicians and staff from participating in prediction markets connected to “government policy, government action, or political outcomes” when they possess or could obtain inside information.30

Then, on January 14, Trump said in a press conference that “The leaker [on Venezuela] has been found and is in jail right now” and would likely face a long sentence. He also noted that “there could be some others”.31 The identity of the leaker, how they gained access to sensitive information, and whether they were also the person who placed the bet has not been disclosed, nor has the charge on which they’ve been jailed.](https://media.hachyderm.io/media_attachments/files/115/923/005/552/119/048/original/bbea7fb0bfd0c7bc.png)

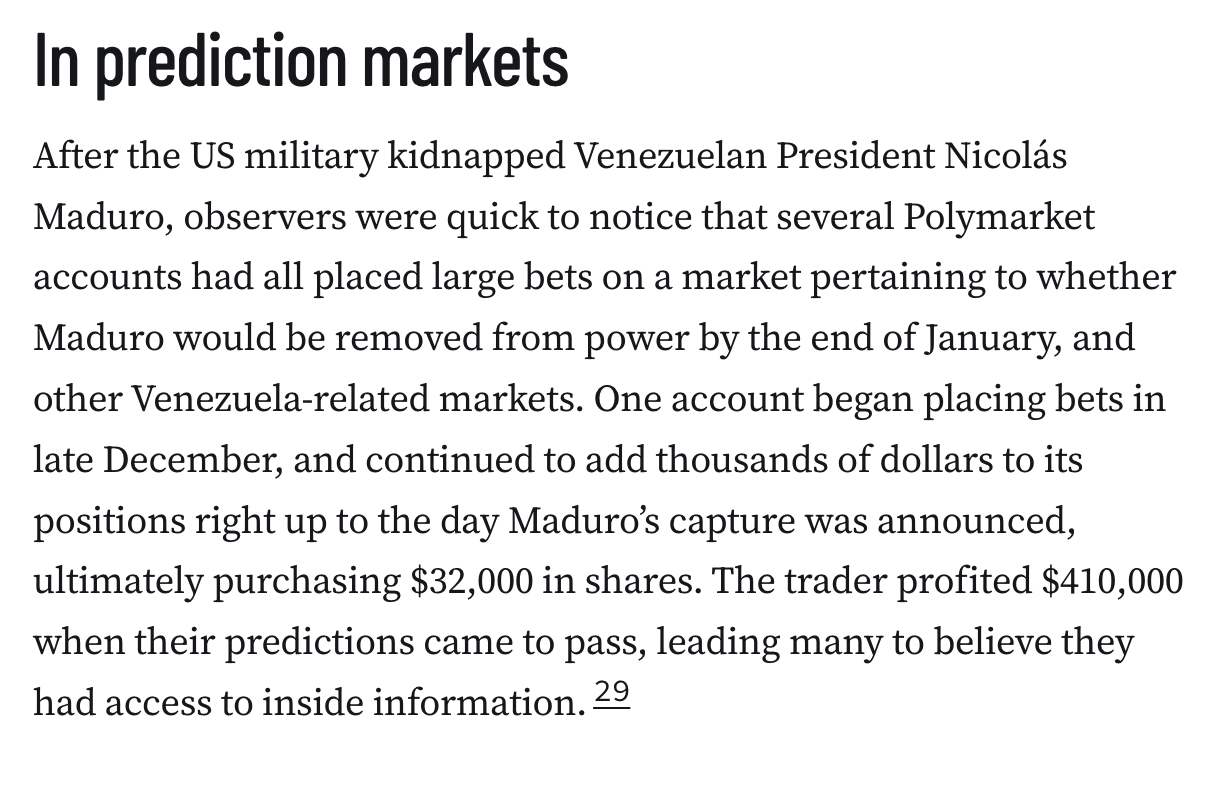

![With all those red flags flapping in the wind, it’s perhaps no surprise that the token launch quickly turned into disaster [W3IGG]. Almost immediately after the token was launched, the project’s liquidity providerd withdrew more than $2.4 million in USDC from the one-sided liquidity pool,e causing the token price to plummet by about 85%. Though the project team later claimed they had been “rebalanc[ing]” liquidity, they only returned $1.5 million to the liquidity pool, with more than $900,000 of it left sitting in the LP wallet. That same wallet then began making automated purchases of $NYC every minute, which the team claimed is part of a TWAP (time-weighted average price) buying strategy. This is a strange explanation that doesn’t address why the third-party liquidity was withdrawn, why it was only partially returned, or why the remaining USDC is now being used in a way that seems intended to create the appearance of sustained demand without any new money actually coming in.](https://media.hachyderm.io/media_attachments/files/115/922/999/207/463/129/original/70da3ea3a985d2eb.png)

![This is nothing new — just the latest demonstration of the crypto industry’s power over Congress after it spent over $130 million installing allies in the 2024 election. Within weeks, House Agriculture Committee Chair GT Thompson (R-PA) made the new power dynamic explicit when he said how crypto legislation was being drafted in “tripartisan” fashion, with the crypto industry forming the new third political wing of Congress [I76].](https://media.hachyderm.io/media_attachments/files/115/922/990/617/149/038/original/f9fbabb42cb3a827.png)